Wedgewood Capital Group focuses on the acquisition and asset management of value-add, multifamily properties. Typically, these are Class B and C assets, built between the 1940s and 1990s, that are well-located in strategic growth markets.

Our goal is to provide our investors with superior risk-adjusted returns via Wedgewood Capital Group’s hands-on approach to an efficient renovation process, while deploying our management / operations team to drive operational efficiencies with the goal of enhancing the tenant experience and marking rents to market.

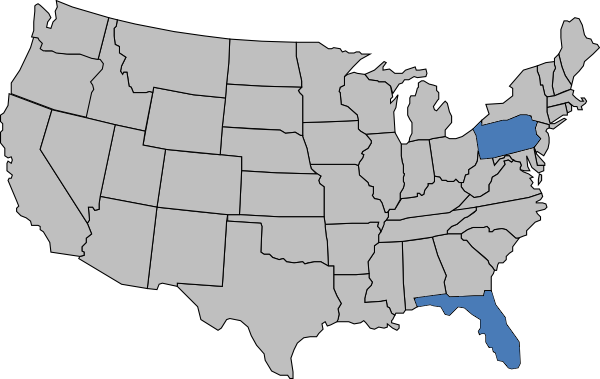

We are seeking Class B & C Multifamily Assets in our target markets with value add opportunities